Small modular reactors (SMRs) are often described as the missing middle of the power system: firm, low-carbon generation that is nimbler than gigawatt-scale megaprojects. The United Kingdom’s civil nuclear roadmap keeps the ambition of up to 24 GW of nuclear by 2050—around a quarter of expected electricity demand—and explicitly sees SMRs playing a role in meeting that goal.

In June 2025, the UK selected Rolls-Royce SMR as preferred bidder to deliver the country’s first SMRs with Great British Energy – Nuclear, targeting mid-2030s grid connection subject to contracts and regulatory approvals. The decision followed a two-year competition and marks a shift from options-scoping to programme delivery.

What Counts as an SMR and Why It Matters

The International Atomic Energy Agency generally defines SMRs as reactors up to about 300 MWe per unit that can be factory-built and shipped for installation. This approach promises quality control, shorter on-site schedules, economies of series and options for multi-module plants. UK interest is led by light-water SMRs, which are closest to today’s fleet, with scope for more advanced concepts later. The near-term focus is on designs that can be licensed and built sooner.

Even that shorthand definition does not tell the whole story. The UK’s most advanced design, the Rolls-Royce SMR, is a pressurised water reactor of roughly 470 MWe. It exceeds the IAEA’s rule-of-thumb power threshold yet is treated domestically as an SMR because the delivery model is modular and repeatable: major components and civil sub-assemblies are designed for factory production, then installed on site in a tightly managed sequence. In this sense, “small” in SMR refers as much to the production unit and replication logic as to nameplate megawatts.

Smaller absolute project size can ease financing. Standardisation across a fleet can compress schedules and costs. Modularisation shifts risk from weather-exposed construction sites to controlled manufacturing environments. When this works, it improves quality control and reduces re-work and delay—two chronic pain points for gigawatt-scale builds. The UK Government’s decision to move from competition to delivery, and to frame SMRs as part of a long-term fleet, reflects recognition that predictability and replicability matter more than sheer size.

The Czech Republic has identified Rolls-Royce SMR as its preferred technology for a national SMR programme, signalling export potential for a UK-developed design—if it proves itself at home. This is not just about deployment: UK–Czech industrial partnerships are beginning to explore joint manufacturing, skills development and regulatory cooperation. Managed effectively, such early endorsements could seed a broader export market for a standardised UK reactor.

The Landscape in 2025: Selection, Sites and Regulators

Rolls-Royce SMR has been named preferred bidder after a staged competition run by the Government’s delivery body, now operating as Great British Energy – Nuclear. Public investment has been signalled for the initial programme, with a plan for a first wave of units pending contracts and approvals. The aim is to sign contracts and allocate an initial site this year and connect in the mid-2030s. The re-badging of Great British Nuclear into Great British Energy – Nuclear reflects its role alongside the broader Great British Energy mission.

Several designs are now moving through the UK’s regulatory pipeline, showing that the emerging market extends beyond a single technology.

The United Kingdom’s Generic Design Assessment is a voluntary process enabling regulators to evaluate a reactor design generically before any site is chosen. It is not a legal prerequisite for construction. Developers may instead apply directly for a Nuclear Site Licence (NSL) under the Nuclear Installations Act 1965, provided they can present a complete site-specific safety case. In practice, bypassing the GDA transfers most design scrutiny into the NSL process, typically extending review timelines and increasing regulatory risk because design and site safety cases must be considered concurrently.

There is structured early regulatory engagement for very small reactor concepts as well. A preliminary design review for a 20 MWe very small reactor was completed under the early-engagement framework, providing targeted feedback to inform later submissions. International developers have been invited as observers in the Rolls-Royce GDA, an unusual but deliberate move intended to promote transparency and competitive learning.

Progress through GDA has been steady and now includes four reactor designs:

- Rolls-Royce SMR entered Step 3 of the UK Generic Design Assessment (GDA) in July 2024, having completed Step 2.

- GE Hitachi’s BWRX-300 and Holtec’s SMR-300 are both in Step 2 of streamlined two-step GDAs, reflecting regulatory willingness to integrate international experience while maintaining UK independence.

- Westinghouse’s AP300 was approved by the Department for Energy Security and Net Zero to enter GDA in August 2024.

- Newcleo’s LFR-AS-200, a lead-cooled fast reactor, entered the GDA process in June 2025 as the first Advanced Modular Reactor (AMR) to undergo formal review in the UK.

Most major vendors—including Rolls-Royce, GE Hitachi, Westinghouse, Holtec and Newcleo—are pursuing the GDA pathway to de-risk subsequent site licensing. A smaller group of developers, however, are opting to bypass GDA. These include Last Energy, which entered directly into the NSL process for its planned 20 MWe microreactors in Wales, having confirmed it does not intend to complete a full GDA, and MoltexFLEX, which aims to license its molten-salt FLEX reactor demonstration at West Burton without undergoing the standard GDA route. Several microreactor or demonstration projects are also exploring tailored licensing arrangements under ONR’s early-engagement and innovation frameworks.

This NSL-first approach may be suitable for smaller or one-off demonstrators, but it removes the fleet-wide efficiency of a generic approval and typically results in longer, more complex licensing timelines.

In October 2025, the Government opened a public consultation on the Nuclear Industry Association’s application for a regulatory justification decision for the Rolls-Royce SMR design. This is the first justification application to reach consultation for a UK reactor design. Conducted by the Department for Environment, Food and Rural Affairs (DEFRA), the process will remain open until 1 December 2025. Justification determines whether introducing a new class of practice delivers a net benefit to society, balancing potential benefits and detriments. A positive decision does not authorise construction but establishes that the technology is acceptable in principle for future licensing. Newcleo has also sought regulatory justification for its LFR.

AMRs and the Evolution Beyond SMRs

Advanced modular reactors (AMRs), often termed Generation IV concepts, are part of the same modular family but differ in both purpose and technical basis. While light-water SMRs represent incremental innovation—smaller, modularised versions of today’s pressurised water reactors—AMRs seek to deliver step-changes in performance, economics and applications. Candidate technologies include high-temperature gas-cooled reactors using TRISO fuel, molten-salt reactors with inherent passive safety features, and sodium- or lead-cooled fast reactors designed for fuel-cycle sustainability.

The UK Government roadmap envisages AMRs for deployment in the 2030s, specifically for high-temperature industrial heat and hydrogen production. Safety considerations are central: while SMRs draw on existing licensing frameworks, AMRs introduce new materials, coolants and safety cases that regulators must address. For example, molten-salt designs have advantages in inherent safety and load-following but require new structural materials and corrosion-resistance validation. High-temperature gas reactors have fuel forms with strong safety performance but require new manufacturing and qualification pathways.

In summary, SMRs are the near-term workhorse, while AMRs are the experimental frontier. Both share modularity, but their safety cases, applications and investment pathways diverge. Policymakers must be clear that AMRs are not simply “SMRs with tweaks” but a fundamentally different generation of reactor with longer development timescales.

Siting Direction: From EN-6 to EN-7

The National Policy Statement for nuclear energy generation is moving from a fixed list (EN-6) to a criteria-based approach (EN-7) that explicitly accommodates SMRs and AMRs. This widens the range of eligible locations while maintaining high standards of safety, security and environmental protection. Unlike EN-6, which effectively restricted development to eight large sites, EN-7 allows developers to make the case based on criteria such as flood risk, aviation corridors, coastal change and cooling sources.

The land picture has evolved. The Government has purchased the Wylfa and Oldbury sites from Hitachi, safeguarding two of the UK’s best nuclear locations. Ministers have also asked the Nuclear Decommissioning Authority and Cumberland Council to unlock land at Moorside in West Cumbria for clean-energy development, potentially including SMRs. In Wales, Cwmni Egino has positioned Trawsfynydd as a prime brownfield candidate, citing its inland location, grid links and community support. This multi-track land strategy reduces development risk and keeps options open.

Former coal power-station sites such as West Burton and Ratcliffe are another practical category. They have large footprints, strong grid infrastructure and cooling options. They also fit the just-transition narrative, offering nuclear redevelopment in communities already familiar with large-scale energy production. Under a criteria-based regime, these sites can be assessed on their merits, with climate resilience and community engagement at the forefront.

SMRs in Practice: Site Typologies and Integrated Uses

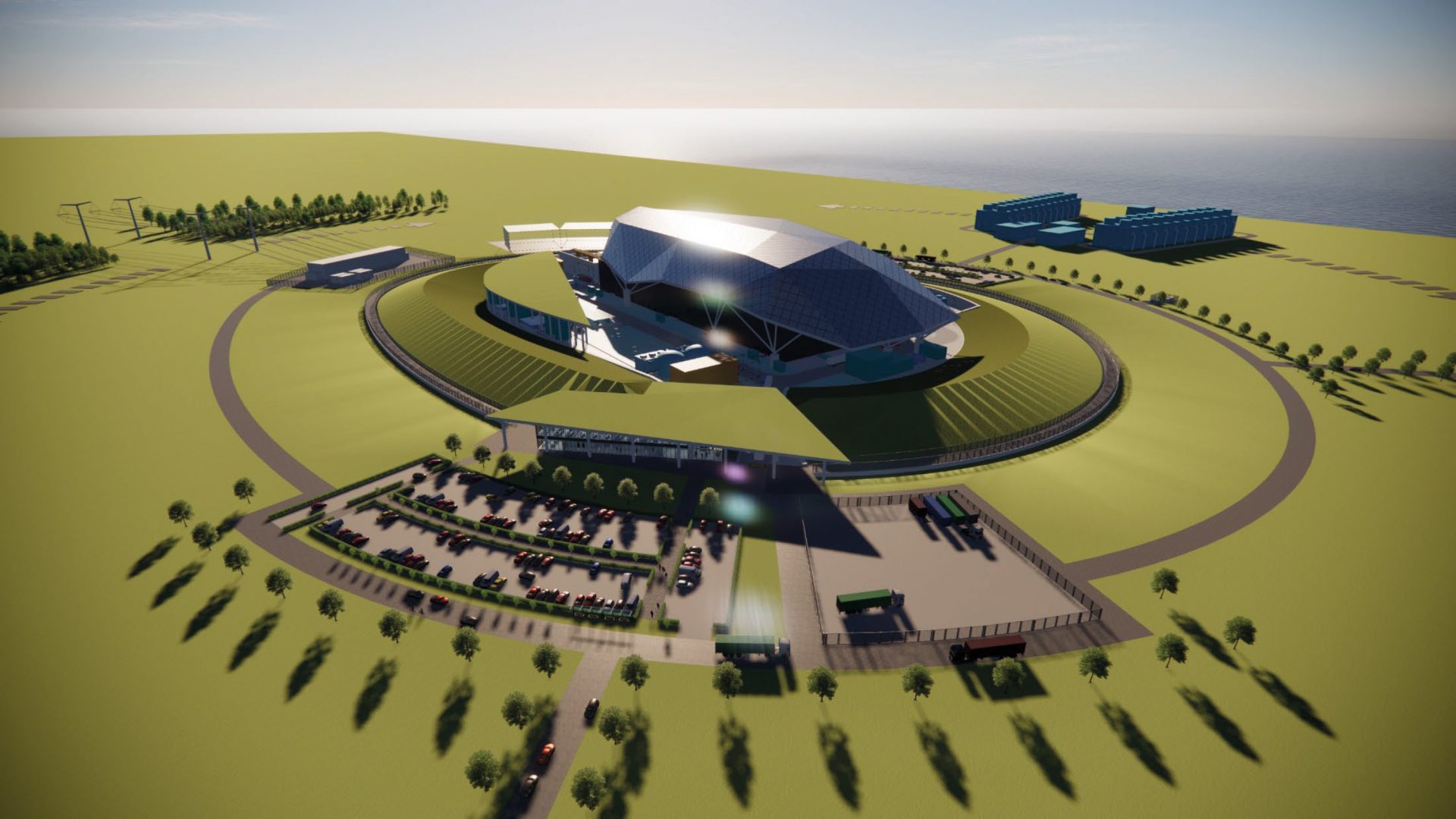

SMRs offer flexible deployment pathways. At one end, multi-unit gigawatt-scale sites could replicate today’s large nuclear plants but with modular reactors, delivering economies of series while providing geographic spread. At the other, single-unit plants could serve regions with lower demand or act as anchor loads for industrial hubs. A third model involves integrated energy hubs, where SMRs operate alongside renewables, storage and flexible loads such as electrolysers or AI-driven data centres.

The advantages of this flexibility are clear: siting closer to demand, easing transmission constraints and enabling cogeneration of electricity, heat and hydrogen. However, there are trade-offs. Some aspects of nuclear deployment do not scale down well: site security, emergency planning zones and safety oversight have fixed cost and complexity regardless of reactor size. A cluster of several small sites may therefore replicate some costs multiple times. Balancing these factors is central to the economics of SMR deployment.

System operators are also exploring what SMRs can contribute to flexibility. While not as rampable as gas turbines, SMRs can follow load to a degree and, when integrated with hydrogen production or storage, can act as anchor assets for flexible clean-energy hubs. In short, SMRs are not just smaller versions of conventional plants—their system role is potentially more dynamic.

Challenges to Watch

Cost and Finance

First-of-a-kind units rarely set the steady-state price. The policy and delivery approach is designed to de-risk early units and build a fleet, but private capital will still require bankable revenue models, disciplined change control and credible contingencies. Smaller project size helps with financing but does not remove the need for robust risk allocation. Potential mechanisms include a regulated-asset-base model, long-term contracts for difference or public co-investment, each with different implications for investor confidence.

Regulation and Delivery

UK regulators will not compromise safety. International collaboration should reduce duplication, but new designs still require rigorous assessment and site-specific safety cases. Programme management must keep design maturity, licensing, planning and procurement aligned—no single stream can progress far ahead of the others without creating churn. A key discipline is recognising hard constraints—regulatory capacity, site consents and supply-chain bottlenecks—and treating them as fixed rather than flexible elements of the programme.

Supply Chain and Skills

Rebuilding nuclear manufacturing and skills at pace is decisive. Execution capacity—people, factories, quality assurance—will determine real-world timelines. A steady cadence of projects is needed to justify investment in tooling and training and to prevent the stop–start cycles that erode productivity. Without clear sequencing, the UK risks over-promising on capacity and under-delivering on quality.

Waste and End-of-Life

SMRs generate spent fuel and radioactive waste like any reactor. The UK’s Geological Disposal Facility programme is progressing through community partnership engagement, with funding mechanisms designed to support potential host communities. Long-term disposal is essential for public confidence. Developers will need clear strategies for interim storage and eventual decommissioning of multiple smaller units.

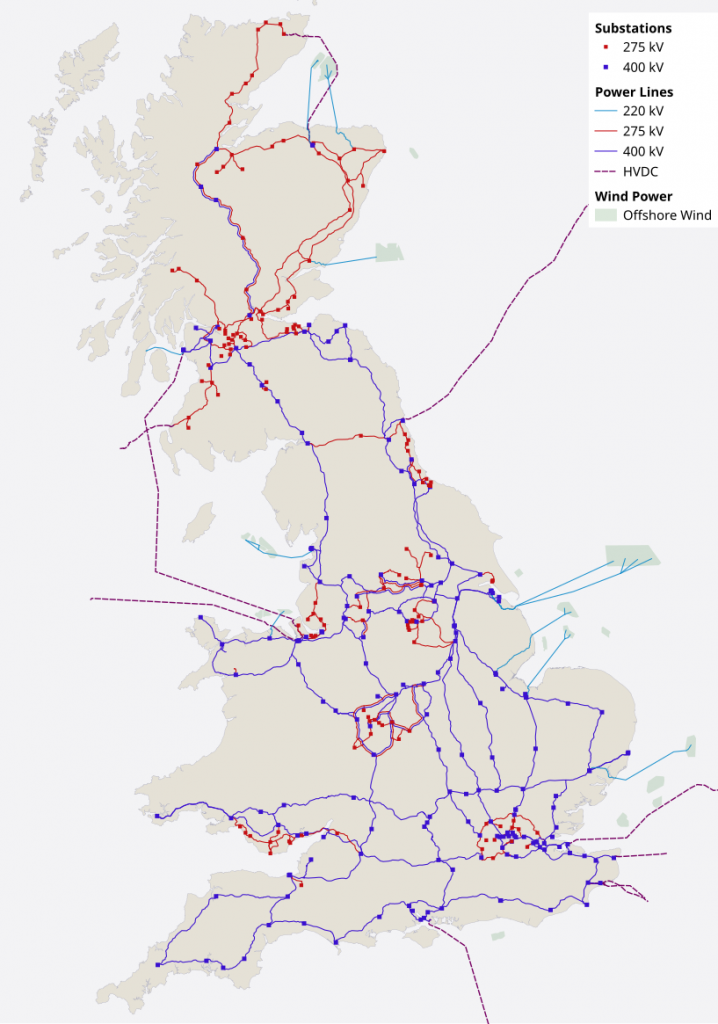

Grid and System Fit

In a renewables-heavy system, firm low-carbon power has outsized value. SMR clusters near demand centres can reduce transmission constraints, provide stability services and, to a point, follow load. Coupling with hydrogen production or heat networks adds flexibility and strengthens the business case. SMRs could also be configured to support rising electricity demands from AI data centres and other energy-intensive industries. Locating firm power close to consumers reduces transmission losses and integrates nuclear generation more tightly into local energy economies.

International Context: UK–US Nuclear Cooperation

During the September 2025 state visit by President Trump, the UK and United States signed a series of agreements deepening cooperation on civil nuclear technology and regulatory alignment. The centrepiece, the Atlantic Partnership for Advanced Nuclear Energy, is intended to promote shared technical standards and mutual recognition of design assessments between the two countries. The goal is to streamline approval processes for advanced reactors by accepting relevant findings from the counterpart regulator, thereby avoiding duplication while maintaining independent national oversight.

The accompanying Tech Prosperity Deal, valued at £31 billion, encompasses AI, quantum, clean energy and nuclear collaboration. It also supports transatlantic investment in SMR deployment, supply-chain development and data-centre integration. The initiative aligns with the UK’s ambition to accelerate licensing and exportability of small reactor technologies while maintaining regulatory integrity.

This cooperative model represents a pragmatic step towards regulatory convergence. It does not imply automatic acceptance of foreign approvals, but it allows joint evidence-sharing, coordinated technical reviews and reciprocal recognition of certain safety or materials assessments, reducing time and cost without diminishing rigour.

A Realistic Outlook

If the first UK SMR can mobilise in 2026–27, secure consents predictably and connect by the mid-2030s within its cost expectations, it will unlock a fleet. The benefits would be significant: firm, low-carbon power at scale; a better geographic spread of energy investment; and an exportable UK industrial product with a deep supply chain. The alternative—delay, cost drift and piecemeal siting—would squander the policy tailwinds now in place.

The building blocks exist: a clear 2050 ambition; a delivery body with a mandate; multiple designs progressing through GDA; a live justification consultation; a siting framework that enables more than it constrains; and regulators collaborating internationally while maintaining standards. SMRs are not a shortcut to cheap power. They are a credible path to faster, more predictable nuclear delivery—provided the hard, unglamorous programme work happens between now and first grid connection.

Practical Next Steps

For policymakers and planners, align local plans and infrastructure strategies with criteria-based siting, and bring grid and water considerations forward in the process. For developers, use the GDA window to lock down sites, supply chains and offtake. For communities, engage early and insist on transparent benefits that endure beyond construction. For the wider supply chain, invest now in nuclear-grade capabilities; the fleet model only works if a repeatable programme can be staffed, certified and delivered.

The United Kingdom now has a clear route to make SMRs a central part of its energy system. Delivery, not rhetoric, will determine whether they become the future of UK nuclear energy.